| g: border-box; orphans: 2; widows: 2; background-color: rgb(255, 255, 255); font-variant-ligatures: normal; font-variant-caps: normal; -webkit-text-stroke-width: 0px; text-rendering: auto;'>Large Chinese companies operating in Guinea are the most likely candidates for delivering an integrated project. With China placing more importance on securing mineral supplies for the next few decades rather than short-term profitability, these firms have a distinct advantage. Moreover, growing concern about the environment and pollution in China is encouraging Beijing to consider building more refineries abroad. Transforming the bauxite into alumina in Guinea would drastically improve the economics and technical development in this west African country. This will also cut down the shipping costs and provide much-needed developments in Guinea.

9. Bauxite and Alumina Institute in Guinea

With the increasing bauxite production and talk of an alumina refinery, it is an appropriate time for Guinea to set up Bauxite-Alumina Institute on the similar lines as India, Jamaica and Suriname for the sustainable development of this vital industry. As observed recently, the haphazard development of bauxite mining has compelled the Governments of Malaysia and Indonesia to partly ban bauxite export from their countries. To avoid this situation, it is utmost necessary to train Guinean nationals and develop R&D Institute for monitoring and systematically develop Bauxite-Alumina industry in a sustainable manner. This will also serve as the centre for training and development of young Guinean engineers and scientists for bauxite research and alumina refinery. The proposed Institute may have the following sections:

- Bauxite Prospecting and Satellite Imagery Analysis

- Resources and Reserve Estimation

- Bauxite Characterization

- Mine Planning

- Environment Management Section

- Mineral Conservation Section

- Technological Tests of Bauxite

- Alumina Production Technology

- Non-metallurgical Bauxite & Special Alumina Section

- Infrastructure Section

- Bauxite Market

The institute work may start with the feasibility report and planning of training programs by an International expert. A strong training and development programs for Guinean nationals can be undertaken to effectively run this Institute.

Conclusions

- The bauxite mining industry is booming in Guinea on the back of demand of Chinese, Russian, Gulf and Indian alumina refineries. The bauxite export from Guinea may exceed to over 110 million tons in 2021.

- Guinea bauxite is the most preferred ore for alumina refineries worldwide thanks to its low reactive silica content and high gibbsitic alumina. Lateritic bauxite occurs in a series of low-level plateaus separated by valleys. Bauxite is easy to mine by drilling-blasting or surface miner and there is about 1 to 2m soil + overburden and in average bauxite ore zone, the thickness is 8m in Boke area. Bauxite is exported as direct shipping ore by simple crushing with or without drying to reduce the moisture content. Recently AGB2A company has started beneficiating their bauxite by dry crushing and screening process and producing one of the best quality metallurgical grade bauxite.

- Along with bauxite export, infrastructure for export in the country is also developing at a fast pace. At present, there are 7 large bauxite mining and export operations in Guinea¨C First 3 at Kamsar port (CBG, GAC/EGA and RUSAL-Dian Dian), one in Conakry (CBK), one from BelAir (Alufer) and 2 from river Nunez (Katougouma and Dapilon). SMB-WAP, JV of Chinese alumina refinery and Singapore Winning Group, is exporting more than 35 million tonnes of bauxite per annum from their river jetties.

- With the construction of 3 more river jetties on river Guemeyire (Fatala) in Guinea¡¯s Boffa Prefecture namely by CHALCO, Kimbo and Kokaya (AGB2A), the bauxite export has further increased during this year. CHALCO has already started bauxite export from their river jetty of Boffa Prefecture. Ashapura, an Indian company has taken over Konta river jetty near Kindia and started iron ore shipment and now planning to export bauxite.

- The booming bauxite mining industry and export from Guinea may change the International bauxite market as lower grade bauxite of India, Indonesia and Australia may face new challenges. China¡¯s declining domestic bauxite output due to inferior quality and high cost of mining continues to accelerate bauxite imports. In 2019, China imported about 100 million tons of bauxite mainly from Guinea, Australia and Indonesia. At presently imported bauxite in China is cheaper than domestic ore and many high-temperature alumina refineries are converting into low temperature mainly based on Guinea bauxite.

- This is an appropriate time for Guinea to set up alumina plant and export value-added product in place of raw bauxite. About 8 bauxite mining companies have put forward their plans, however, alumina projects are yet to be materialized.

- For sustainable development of bauxite mining, export and alumina refinery, it is necessary to set up Bauxite-Alumina Institute in the country to facilitate all the R&D work including bauxite characterisation, resource-reserve estimation, mine planning and work on the process technology for alumina production.

Dr Ashok Nandi, President of International Bauxite, Alumina and Aluminium Society (IBAAS)

Dr Ashok Nandi is well-known bauxite-alumina expert and worked in Guinea bauxite during his tenure in BHP-Billiton. At present Dr Nandi is working as an independent consultant and providing his services to worldwide projects including bauxite companies of Guinea.

email: ashok.nandi@ibaas.info; info@ibaas.info; Web site: http://www.ibaas.info/; Cell Number +91 9823015772

Dr Alkaly Yamoussa BANGOURA, Advisor, Mining Affairs at the Presidency of Guinea

Dr Alkaly Yamoussa Bangoura a Geological Engineer is Advisor for Mining at the Presidency in Guinea. He has held many senior positions at the Ministry of Mines and thaught at Bok¨¦ School of Mines. ,Guinea with bauxite potential of about 40 billion tons is the largest aluminium ore exporter in the world today. During 2019, the country exported about 70 million tons of bauxite, which is likely to exceed 110 million tons by 2021. This may substantially change the present bauxite market and significantly affect other bauxite producing countries of the world. Guinea exports one of the best and low-cost metallurgical grade bauxite in the world today. The ore is natural low silica (2.5%), medium alumina (44-46%) gibbisitc bauxite, where reactive silica is only 1.2 to 1.5%, which makes this one of the best aluminium ore in the world. The present paper describes bauxite geology, basic characteristics, current and future bauxite mining, infrastructure developments and export from Guinea with details of various mining companies active in this country. About 8 bauxite mining companies have put forward their plans to set up greenfield alumina refineries in Guinea and some of them are in the feasibility stage. In the past also, several attempts were made for value addition within the country, however, none of them materialized. Now, this is an appropriate time for the Government of Guinea to push mining companies to set up new alumina plants in the country. In order to have sustainable bauxite mining development and prepare local technical manpower for alumina refinery, Guinea must set up Bauxite-Alumina Institute and prepare/train locals to effectively run this vital industry.

1. Introduction

Guinea, a small West African country with a population of 12.4 million and an area of 245,857 square kilometres, is the largest bauxite exporter in the world today. The bauxite mining industry is booming in this country and at the same time, the necessary infrastructure for export is also being developed here. The metallurgical grade bauxite resources in Guinea is estimated to be about 40 billion tons and thus occupies the top position in the world. Guinea¡¯s bauxite industry is flourishing on the back of major miners- SMB, CBG, RUSAL, GAC/EGA, CHALCO, Alufer and scores of other bauxite exploration-mining companies. During 2019, the country exported about 70 million tons of bauxite, which is likely to be about 90 million tons during 2020. Guinea exports one of the best and low-cost metallurgical grade bauxite in the world today. Bauxite mainly occurs in low-lying flat-topped plateaus at an elevation of 200 to 400m above MSL (mean sea level). Laterite-Bauxite starts from the surface with thin soil cover (<0.5m) and low overburden (about 1m). The average thickness of the bauxite ore zone is about 6 to 8m, which makes mining operation quite simple and cost-efficient. Guinea ore is natural low silica (2.5%), medium alumina (44-46%) gibbisitc bauxite, where reactive silica is only 1.2 to 1.5%, which makes this one of the best aluminium ore in the world. The present paper describes the current status of bauxite mining and export from Guinea with details of various mining companies active in this country. Varying quality of metallurgical grade bauxite is being produced in the mines of Guinea and some companies have even started beneficiating the ore. The bauxite mining scenario is fast changing with the entrance of several companies from all over the world and it is expected that during the 2021 period bauxite production in Guinea may exceed 100 million tons per annum. This may substantially change the present bauxite market and significantly affect other bauxite producing countries of the world.

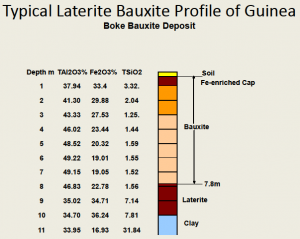

2. Bauxite Geology and Ore Characteristics The lateritic bauxite deposits of Guinea occur at low levels (200 to 400 m above MSL) in the flat-topped plateaus with practically negligible soil and overburden. The bauxite is underlain by a stacked pile of argillite, siltstones and minor sandstone intercalations of the Lower and Upper Members of the Faro Suite, widely intruded by sills and dykes of Mesozoic dolerites. A typical laterite bauxite profile of Guinea is shown here (Figure-1).

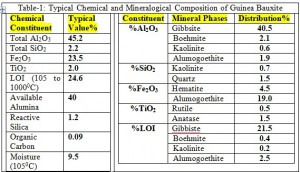

The Boke bauxite belt is the most prolific in Guinea and here average thickness of bauxite zone is about 8 to 10 meters with little soil cover and iron-rich cap of about 1 to 2 m. Bauxite forms as a result of intense tropical weathering and made up essentially of hydrated aluminium and iron oxides. One of the interesting features of Guinea bauxite is the natural low silica content (~2.5%) and about only 50% is reactive (~1.2%), which makes this ore most favourable for alumina production by low-temperature digestion. Alumina content in bauxite varies from medium (40%) to as high as 54% and, on average, have 45-46% alumina (about 40-41% available alumina). Further lateritic bauxite of Guinea is gibbisitc in nature with about 2% alumina is in the form of boehmite, particularly in the Boke region and this is mainly concentrated on the top layer of profile. Only high-grade Sangaredi sedimentary bauxite of CBG has high monohydrates, however, this is fast depleting now. Bauxite deposits, occurring near the coastal belt of Guinea sometimes have relicts Andalusite and Pyrophyllite minerals, which reduces the available alumina content in the ore. Table-1 shows typical chemical and mineralogical analysis of Guinea Boke bauxite.

As observed above, apart from Boehmite, a considerable substitution for Fe by Al may take place within the goethite crystal structure. The other impurities like organic contents and minor deleterious elements like zinc, sulphur and calcium are quite low in this bauxite. Although from alumina processing point of view, MRN Trombetas bauxite of Brazil and washed ore of SMHL/Vimetco, Sierra Leone are considered the best in the world, however, these are beneficiated washed ore with comparatively higher cost in the world market. Some of the negative features of Guinea bauxite are higher Goethite to Hematite ratios, which causes the red mud settling the issue in the refinery. Further higher boehmite content, particularly in the Sangaredi sedimentary bauxite of CBG, have a negative impact on available alumina in the low-temperature alumina refineries. Some bauxites of Guinea also contain Andalusite mineral, which locks up a part of alumina and despite high alumina content, available alumina is low in this ore. Some of these bauxite quality issues of Guinea bauxite can be resolved by an appropriate beneficiation process.

3. Bauxite Exploration and Mining Leases

Guinea is an exciting place to be with all the bauxite projects that are under development and is holding nearly a third of the world bauxite resources; it is likely to be a supplier of bauxite for many years to come. The latest bauxite cadastral map provides a list of companies having bauxite mining, exploitation license and exploration permit and same can be seen in the website https://guinee.cadastreminier.org/en/. In Guinea, 17 companies have got mining concessions and among them, only 6 companies namely Societe Global Alumina (GAC/EGA), Aluminium Company of Guinea (Fria), Compagnie des Bauxites de Kindia (CBK), Compagnie des Bauxites de Guinee (CBG), Henan Chine and Compagnie des Bauxites de Dian-Dian (COBAD) are presently mining bauxite. Apart from these, there are 14 leases having exploitation licenses in Guinea, which allows them to mine bauxite and export. Here 7 companies namely Societe Miniere de Boke SA (SMB), Societe Bel Air Mining SA (Alufer), Chalco Guinea Company SA, Societe Guineenne des Mines (GDM), Societe Alliance Miniere Responsable Sarl (AMR), AGB2A (GBT and Axis Minerals) and Ashapura Minechem have started bauxite mining and export. There are about 65 bauxite exploration licenses, which are in various stages of developments.

4. Leading Bauxite Mining Companies

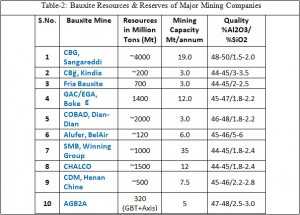

There are at present 10 active bauxite mining companies in Guinea, the oldest among them is CBG and the largest producer is SMB-Winning Group. From a resource point of view, the CBG concession area is endowed with more than 4 billion tons of bauxite and this is the highest among all the operating bauxite mines. Bauxite is mined by open cast mining method by drilling blasting as well by the surface miner. More and more Guinea bauxite is now being exploited by a surface miner as this is found an efficient and environment-friendly technique and does not require ore crushing. The present bauxite resources and mining capacity of major mining companies are quite healthy as one can see in the Table-2.

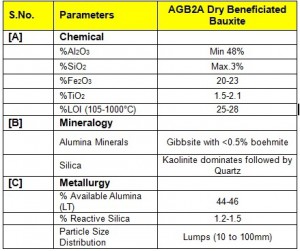

This indicates that bauxite resources of Guinea may run for many years to come, although the quality may come down, particularly in terms of alumina, for some of these mines. Silica rarely goes high in Boke bauxite despite lower alumina values, however, Kindia may have instances of slightly higher silica. Among the above-mentioned mines, AGB2A has first time started the bauxite beneficiation in Guinea by dry crushing and screening technique and producing one of the best quality ore as evident in the table given below: Table-3: Dry Beneficiated Bauxite Quality of AGB2A, Guinea

In the process of this dry beneficiation of bauxite, a large quantity of fines are being generated at the mine site as a recovery of high-grade ore is only in the range of 50-60%. Further washing and drum scrubbing tests are planned to recover bauxite values for these rejected high silica fines.

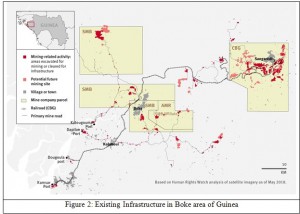

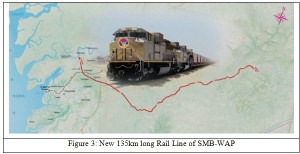

5. Infrastructure for Bauxite Export In the last 6 years with the entrance of Chinese companies, the whole infrastructure scenario of Guinea has undergone a sea change and about 6 large river jetties are built apart from developed Kamsar and Conakry ports. Out of these 5 jetties of SMB (2), CHALCO, AGB2A and Ashapura are already operational and remaining one of Kimbo will be started shortly. Developments of these river jetties have completely changed bauxite export scenario of Guinea and at present 220,000 to 300,000 tons vessels are being loaded. SMB (Soci¨¦t¨¦ mini¨¨re de Bok¨¦), joint Chinese Alumina plant- Winning Group of Singapore, known as SMB-WAP is the largest among them. The consortium has two large river jetties known as Katougouma and Dapilon (Figure-2), each with a processing capacity of about 25 million tons of bauxite. They have brought a series of marine logistics equipment, making it the first bauxite company in Guinea to export more than 35 million tons per annum. The production and export of bauxite are expected to reach 50 million tons target by 2021-22. SMB has also launched a new 135-kilometre rail line, which connects Santou-Houda bauxite deposits to its Dapilon river port (See Figure-3). The Sangar¨¦di-Kamsar railway line and the port of Kamsar are now shared by CBG, COBAD and GAC.

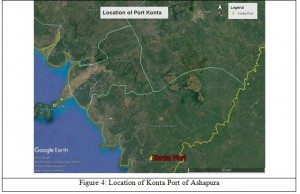

Three large bauxite jetties developed on the river Guemeyire (Fatala) in Guinea¡¯s Boffa Prefecture namely by CHALCO, Kimbo and Kokaya (AGB2A). Another river jetty named as Konta port has been developed by Ashapura, an Indian company. They export iron ore and also planning to export bauxite of forwarding Africa Resources (FAR) from Konta port (See Figure-4).

6. Present Mining & Future Projection

In the opencast mines of CBG, Bauxite is exploited by simple drilling-blasting technique and loaded into the trucks as shown in Figure-5. Bauxite is crushed, blended and partly dried at Kamsar port before export. RUSAL at their Kindia operation uses Surface Miner (Figure-6) to directly produce <100mm bauxite, which is exported from Conakry port without drying. SMB, a Chinese company, mines bauxite by drilling-blasting and exports medium grade (44%-45% Alumina) bauxite from the jetty on river Nunez. Now SMB is also using surface miner along with traditional drilling blasting.

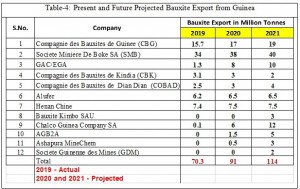

There is no processing or beneficiation required for Guinea bauxite as they have natural low silica and except CBG other companies export bauxite without any drying. According to the plan of various active companies of Guinea, the bauxite production and export from Guinea is likely to increase significantly in the coming years. A simple projection of bauxite production and export by leading mining companies is provided in Table-4.

There is a clear indication of increasing bauxite export from Guinea and more and more Chinese alumina refineries will depend on this ore.

7. Present International Bauxite Market

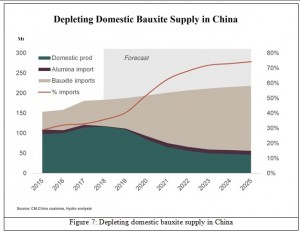

With the given bauxite export forecast of Guinea, there may be fierce competition and countries exporting high silica and boehmitic bauxite may face new challenges. The present alumina prices will also put pressure and only bauxite with high available alumina and low reactive silica may survive in the competition. China is undoubtedly the biggest consumer of bauxite and some alumina refineries have been built in the recent past based on imported gibbisitc bauxite of Guinea. According to Antaike, the research arm of the China Nonferrous Metals Industry, China is expected to add 4.7 million tonnes of alumina production capacity in 2020 and China¡¯s total production may rise by 3.3% to 73.98 million tonnes per annum. Bauxite resources in China are concentrated in regions such as Guangxi, Guizhou, Henan, and Shanxi. Chinese origin bauxite supply becomes tight because of strict environmental protection policy and the local bauxite is at present costlier than the imported ore of Guinea. Alumina refineries in Henan and Shanxi have also started using imported bauxite. Demand for imported bauxite will continue to rise and Guinea will be a major contributor. Chinese domestic bauxite production peaked in 2018 and now declining on depleting reserves, lower grades and environmental constraints as shown in Figure-7. China¡¯s declining bauxite output continues to accelerate bauxite imports. It is estimated that in 2020-21, only 70 million tonnes of domestic bauxite will be used. Keeping in view the total alumina production in China as 74 million tonnes with an average bauxite consumption of about 2.6 tonnes, the bauxite requirement in China may be in the range of 190 million tonnes and out of this, about 70 million tonnes will be sourced from domestic mines. This will lead to import of about 120 million tonnes bauxite by China and the majority of this will be sourced from Guinea thanks to superior bauxite quality and fast developing infrastructure.

According to Asian Metal report, China imported about 100.6 million tons of bauxite during 2019, out of this 70.7 MT was gibbsitic ore (i.e. bauxite from Guinea, Indonesia, Brazil, Malaysia and India) and about 29.9 MT boehmitic ore (i.e. bauxite from Australia and other countries). Guinea exported about 44.4 million tons of bauxite to China during 2019 and remaining 25.9 Mt ore was exported to all over the world. The proportion of Guinea bauxite to China may further increase in 2020 as observed in the present trend of this year. In 2019, Guinea, Australia and Indonesia remained the top three bauxite exporters to China with their combined volume of 94.9 Mt. The bauxite demand in India will be comparative slow as alumina industry is growing at a slower pace and country has its mines of medium grade bauxite. However, some of the good bauxite deposits are located in the deep forest and ecologically sensitive areas with a population of tribes. Presently VEDANTA and HINDALCO alumina refineries are importing bauxite from Guinea and Sierra Leone and total may reach maximum to 10 million tonnes in coming years if VEDANTA goes ahead with its alumina expansion plan and ANRAK starts operating its new plant of Andhra Pradesh.

8. Prospects of Greenfield Alumina Plants

The Fria alumina refinery was started in 1960 by Aluminium Pechiney, France followed by Reynolds Company and then Rusal since 2008. This is the only alumina refinery in the whole of Africa. The management of the Alumina Company of Guinea (Friguia Refinery) was taken over by RUSAL for 22 years in 2002. The estimated capacity of this refinery is 700,000 tonnes of alumina and 3 million tonnes of bauxite per annum. However, at present, this plant is producing less than 300,000 tons of low-quality alumina per annum. The refinery¡¯s infrastructure includes a 160 km long railway network used for transportation of products, raw materials and fuel.

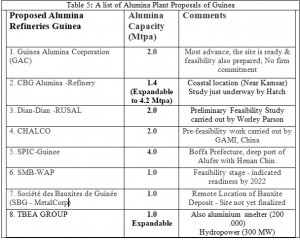

In 2012, the refinery had stopped production due to high operating cost and local issues. However, in 2018 the refinery was again revived by RUSAL and presently running at a capacity of about 280,000 tonnes per annum. It is time for Guinea to reap the benefit of the large bauxite mining industry and add value in the country, similar to Indonesia, where bauxite export is allowed along with the setting up of alumina plants. Several companies, operating in Guinea have signed contracts to construct refineries ¨C subject to feasibility studies − to accompany their mining developments. Yet none of them made a real effort to deliver an integrated project, despite the government offering a strong financial incentive. While the state takes a minimum share of 15% in mining-only developments, this falls to a mere 5% for integrated projects, enabling firms to retain a bigger slice of the profits. However, this inducement has been unable to outweigh companies¡¯ concerns over the lack of skilled workers and energy sources locally to power refineries. A list of companies intends to set up alumina refineries in Guinea are given in Table-5.

Register now for free! |